Andy Altahawi's recent decision to list his company on the New York Stock Exchange (NYSE) through a direct listing has sent shockwaves throughout the financial world. Barron’s This unorthodox approach, eschewing conventional IPO methods, is seen by many as a bold move that transforms the existing structure of public market offerings.

Direct listings have become popularity in recent years, particularly among companies seeking to reduce expenses associated with traditional IPOs. Altahawi's decision highlights this trend, suggesting a growing need for more streamlined pathways to going public.

The move has captured significant interest from investors and industry analysts, who are closely watching to see how Altahawi's direct listing will influence the company's trajectory. Some argue that the move could unlock significant value for shareholders, while others remain reserved about its long-term viability. Only time will tell whether Altahawi's direct listing will be a game-changer for his company and the broader financial landscape.

Altahawi & Co. Eyes NYSE, Bypassing Traditional IPO Path

In a move that signals ambition and boldness, Altahawi & Co., the burgeoning investment powerhouse, is aiming for a listing on the New York Stock Exchange (NYSE). This forward-thinking move represents a departure from the traditional initial public offering (IPO) route, highlighting the company's confidence in its unique approach. Sources indicate Altahawi & Co. is exploring non-traditional market access, potentially leveraging a hybrid model to expedite its journey to public markets.

- The implications of Altahawi & Co.'s strategy remain to be seen, but it is already generating considerable buzz in the investment community.

- Companies across various sectors are increasingly opting for alternative listing mechanisms

The New York Stock Exchange Set for Direct Listing of Andy Altahawi's Venture

Investors are excited about the arrival of Andy Altahawi's venture, which is set for a direct listing on the NYSE. Altahawi, a renowned entrepreneur, has built his company into a rapidly growing success in the healthcare sector. Analysts are skeptical about the company's potential, and the debut is expected to be a major milestone for both the company and the NYSE.

The Altahawi Effect: Could Direct Listings Become the New Normal?

The recent surge in direct listings, spearheaded by prominent names like Spotify and Slack, has sparked a debate within financial circles. Supporters argue that this novel approach to going public offers significant perks for both companies and investors. Conversely, critics raise concerns about the potential risks associated with direct listings, particularly in terms of price discovery.

- Furthermore, the Altahawi Effect, named after the founder of OpenSea who famously opted for a direct listing, suggests that this trend could potentially revolutionize the traditional IPO landscape.

- Whether direct listings will truly become the new normal remains to be seen. However, their growing popularity indicates a transformation in the way companies choose to access public capital.

Exploring Andy Altahawi's NYSE Direct Listing Approach

Andy Altahawi has emerged as a prominent figure in the financial world, known for his innovative and sometimes controversial approaches to capital markets. His recent foray into direct listings on the New York Stock Exchange (NYSE) has garnered significant attention, with many investors and analysts intently following his every move. Altahawi's strategy stands apart from traditional IPOs by bypassing underwriters and allowing companies to directly offer their shares to the public. This bold approach has shown positive outcomes for some, but it remains a risky proposition for others.

Altahawi's history in direct listings is significant, with several companies under his guidance achieving strong initial valuations. However, critics argue that the lack of an underwriter can lead to fluctuations in share prices and increased market uncertainty. Despite these concerns, Altahawi remains confident about the future of direct listings, believing that they offer a more efficient path to public markets for innovative companies.

- However the controversy surrounding his methods, Altahawi's influence on the capital markets is undeniable.

- His strategies have challenged traditional IPO processes, and their impact will likely endure for years to come.

Analyst Predictions: Will Altahawi's Direct Listing prove to be a Success?

The upcoming direct listing of Altahawi has analysts divided. While some believe the move could yield significant value for shareholders, others express concerns about the novelty of the approach. Factors such as market conditions, investor attitude, and Altahawi's capacity to handle the listing process will crucially determine its success. The outcome is uncertain whether Altahawi's direct listing will set a precedent for other companies seeking an alternative path to the public markets.

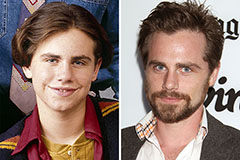

Rider Strong Then & Now!

Rider Strong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Shane West Then & Now!

Shane West Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!